Understanding the Concept of a Good Salary in India

In a country as diverse and dynamic as India, determining what constitutes a good salary can be a nuanced task. While certain figures may seem substantial in one region, they might fall short in another due to variations in living costs, lifestyle preferences, and societal expectations.

Factors Influencing Salary Expectations

Several factors play a crucial role in shaping the perception of a good salary:

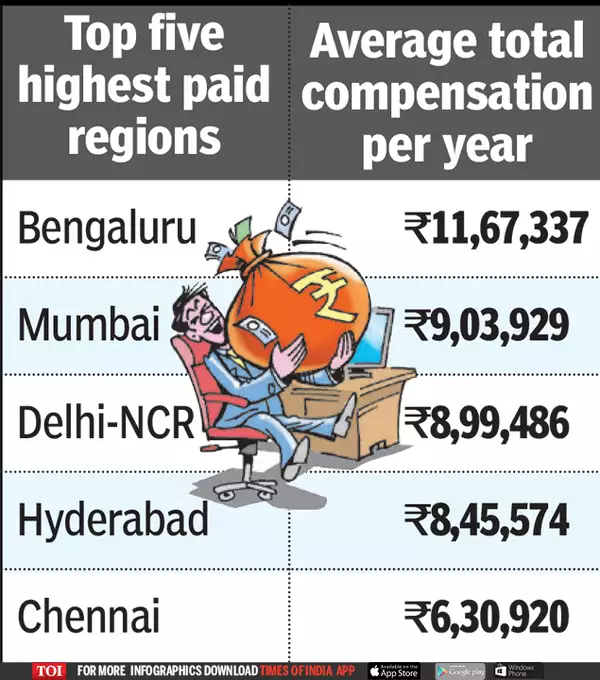

1. Location:

The cost of living can vary significantly from one city to another. For instance, a salary considered comfortable in a tier-II city might not suffice in a metropolitan area like Mumbai or Delhi due to higher expenses related to housing, transportation, and leisure activities.

2. Industry and Job Role:

Salaries differ across industries and job roles. Professions such as software engineering, finance, and healthcare tend to offer higher remuneration compared to others. Additionally, specialized skills and experience often command higher pay.

3. Experience and Qualifications:

Employers typically offer higher salaries to candidates with relevant experience and advanced qualifications. As individuals progress in their careers and acquire new skills, they can negotiate better compensation packages.

4. Company Size and Reputation:

Established companies with a strong market presence often provide more competitive salaries and benefits to attract and retain top talent. Startups and smaller firms may offer equity or other incentives in lieu of higher salaries.

5. Economic Factors:

Macroeconomic conditions, such as inflation rates, GDP growth, and industry performance, can influence salary trends. During periods of economic expansion, companies may increase wages to remain competitive and retain skilled employees.

Benchmarks for a Good Salary

While there is no one-size-fits-all answer to what constitutes a good salary, certain benchmarks can provide guidance:

1. Basic Needs:

A good salary should cover essential expenses such as housing, food, healthcare, education, and transportation comfortably. It should also allow for savings and discretionary spending to maintain a decent standard of living.

2. Savings and Investments:

Ideally, a significant portion of one’s income should go towards savings and investments for future financial security. This includes contributions to retirement funds, emergency funds, and long-term investments such as stocks, mutual funds, or real estate.

3. Lifestyle and Aspirations:

A good salary enables individuals to pursue their passions, hobbies, and leisure activities without financial strain. It should provide opportunities for travel, entertainment, personal development, and philanthropy based on individual preferences and priorities.

4. Career Growth and Advancement:

Beyond immediate financial rewards, a good salary should support career growth and advancement opportunities. It should align with long-term career goals and offer prospects for skill development, promotions, and increased responsibilities.

Conclusion

Determining a good salary in India involves considering various factors such as location, industry, experience, and economic conditions. While specific figures may vary, individuals should prioritize financial stability, savings, lifestyle preferences, and career growth when evaluating salary offers. By understanding these factors and benchmarks, individuals can make informed decisions to ensure their financial well-being and pursue their aspirations effectively.